Insurance is a cornerstone of financial planning, offering protection and peace of mind in the face of unforeseen events. While it’s an essential aspect of our lives, many individuals find the world of insurance complex and often overwhelming. In this article, we will delve into some basic knowledge about insurance, demystifying key concepts and providing a foundation for understanding how insurance works.

1. The Fundamental Purpose of Insurance:

At its core, insurance is a financial tool designed to protect individuals, businesses, and assets from the financial impact of unexpected events. These events, often referred to as risks or perils, can include accidents, illnesses, property damage, or even death. Insurance serves as a safety net, providing financial compensation or coverage to help individuals recover from these events and mitigate the associated costs.

2. Key Players in the Insurance Process:

Insured/Policyholder: The person or entity purchasing an insurance policy is known as the insured or policyholder. This individual pays premiums to the insurance company in exchange for coverage and protection against specific risks.

Insurance Company/Insurer: The entity providing the insurance coverage is the insurance company or insurer. Insurers collect premiums from policyholders and, in return, commit to providing financial protection as outlined in the insurance policy.

Agent/Broker: Insurance agents or brokers act as intermediaries between the insured and the insurance company. Agents work for a specific insurance company, while brokers may work independently, representing multiple insurers. Their role is to assist individuals in choosing appropriate coverage and facilitating the purchase of insurance policies.

Underwriter: Underwriters assess the risk associated with insuring a particular individual, property, or entity. They evaluate factors such as health status, driving history, or property conditions to determine the appropriate premium and coverage.

Claim Adjuster: In the event of a covered loss, claim adjusters investigate and assess claims. They work on behalf of the insurance company to determine the extent of the loss, negotiate settlements, and ensure that policyholders receive the benefits outlined in their policies.

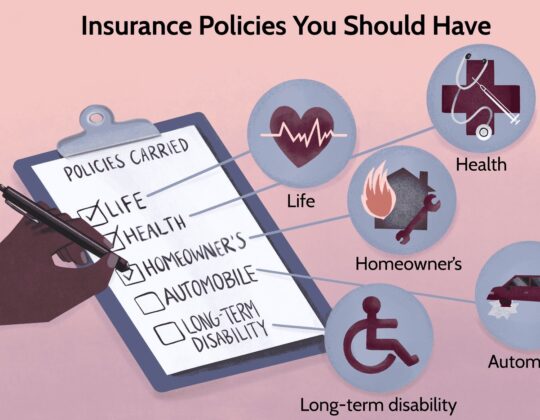

3. Types of Insurance:

Insurance comes in various forms, each designed to address specific needs and risks. Some common types of insurance include:

Health Insurance: Provides coverage for medical expenses, including doctor visits, hospital stays, and prescription medications.

Auto Insurance: Protects against financial loss due to damage to or theft of a vehicle. It may also include liability coverage for injuries or property damage caused by the insured while driving.

Homeowners Insurance: Covers damages to a home and its contents, as well as liability protection for injuries that occur on the property.

Life Insurance: Provides a death benefit to beneficiaries in the event of the policyholder’s death. It can serve as financial protection for dependents and may also have a cash value component.

Renters Insurance: Offers coverage for personal property within a rented dwelling and may include liability protection.

Disability Insurance: Provides income replacement if the insured becomes unable to work due to a disability.

Business Insurance: Includes various policies tailored to protect businesses, such as commercial property insurance, liability insurance, and business interruption insurance.

4. Premiums and Deductibles:

Premiums: The amount policyholders pay for insurance coverage is known as the premium. Premiums can be paid on a regular basis, such as monthly or annually, and are determined based on factors such as the type of coverage, coverage limits, deductibles, and the policyholder’s risk profile.

Deductibles: A deductible is the out-of-pocket amount the policyholder is responsible for paying before the insurance coverage kicks in. For example, if you have a $500 deductible on your auto insurance and incur $1,000 in damages, you would pay the first $500, and the insurance company would cover the remaining $500.

5. Policy Limits and Coverage:

Policy Limits: Every insurance policy has coverage limits, which represent the maximum amount the insurer will pay for a covered loss. It’s crucial for policyholders to understand these limits to ensure adequate protection.

Coverage: The coverage provided by an insurance policy specifies the types of risks or perils that are included in the policy. For example, a comprehensive auto insurance policy may cover damages from theft, vandalism, and natural disasters, in addition to collision coverage.

6. Underwriting and Risk Assessment:

Underwriting: The process of underwriting involves evaluating the risk associated with insuring a particular individual, property, or entity. Underwriters consider various factors, including health status, driving history, and property conditions, to determine the appropriate premium and coverage.

Risk Assessment: Insurance companies assess the likelihood and potential severity of a loss through risk assessment. This evaluation helps determine the level of risk an insured presents and influences the underwriting decisions.

7. Claims Process:

Filing a Claim: When an insured event occurs, the policyholder initiates the claims process by filing a claim with the insurance company. This involves providing documentation, details of the event, and any necessary evidence to support the claim.

Claim Adjusters: Claim adjusters, also known as insurance adjusters, investigate and assess claims on behalf of the insurance company. They determine the validity of the claim, assess the extent of the loss, and negotiate settlements.

Settlement: If the claim is approved, the insurance company provides a settlement to the policyholder. The settlement amount is based on the terms outlined in the insurance policy and may cover repair costs, medical expenses, or other covered losses.

8. Exclusions and Limitations:

Exclusions: Insurance policies often have exclusions, which are specific situations or events that are not covered by the policy. It’s essential for policyholders to review and understand these exclusions to avoid surprises when filing a claim.

Limitations: In addition to exclusions, policies may have limitations that restrict coverage under certain circumstances. For example, a health insurance policy may have limitations on coverage for pre-existing conditions.

9. Renewal and Cancellation:

Renewal: Many insurance policies are renewable, allowing policyholders to extend or continue their existing coverage. It’s crucial to review your coverage during the renewal period to ensure it still meets your needs.

Cancellation: Insurance companies have the right to cancel a policy under certain conditions, such as non-payment of premiums or misrepresentation of information during the application process. Policyholders should be aware of the terms and conditions that may lead to policy cancellation.

10. Risk Management and Prevention:

While insurance provides financial protection, risk management and prevention play a vital role in reducing the likelihood of losses. Individuals and businesses can take proactive steps to minimize risks, such as implementing safety measures, maintaining good health practices, and investing in security systems.

In Conclusion: Building a Foundation of Understanding

This overview provides a foundation of basic knowledge about insurance, aiming to demystify key concepts and empower individuals to make informed decisions. Insurance is a dynamic and evolving field, and staying informed about policy terms, coverage options, and the claims process is crucial for maximizing the benefits of insurance protection.

As you navigate the world of insurance, consider consulting with insurance professionals, such as agents or brokers, who can provide guidance tailored to your specific needs. Remember that insurance is not just a financial transaction; it’s a tool that offers security, peace of mind, and a safeguard against life’s uncertainties. By building a solid understanding of basic insurance principles, you are better equipped to make choices that align with your goals, protect your assets, and contribute to your overall financial well-being.