Selecting the right insurance company is a crucial decision that directly impacts your financial security and peace of mind. With numerous options available, finding a reliable insurance company can be a daunting task. In this article, we’ll explore key considerations and strategies to help you navigate the landscape of insurance providers and make an informed choice that aligns with your needs.

1. Define Your Insurance Needs:

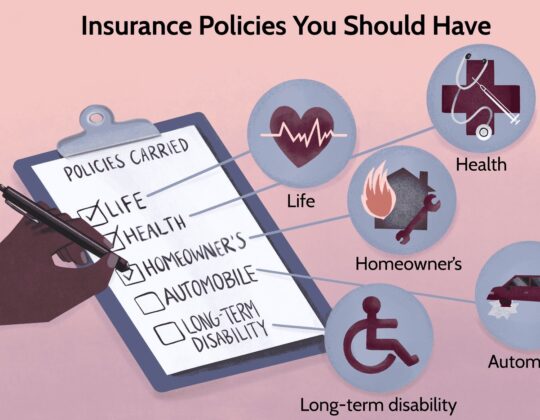

Before embarking on the search for a reliable insurance company, it’s essential to clearly define your insurance needs. Consider the type of coverage you require, whether it’s auto, home, health, life, or a combination of these. Assess your specific needs, such as coverage limits, deductibles, and any unique considerations based on your circumstances. This clarity will serve as a guide when evaluating potential insurance providers.

2. Research and Compare:

Conducting thorough research is a fundamental step in finding a reliable insurance company. Leverage online resources, customer reviews, and industry ratings to gather information about different insurance providers. Explore the websites of potential companies to understand their offerings, coverage options, and any unique features they provide. Pay attention to customer testimonials and reviews to gain insights into the experiences of policyholders.

Utilize comparison tools and websites that allow you to receive quotes from multiple insurance companies simultaneously. This can streamline the process of comparing premiums, coverage details, and customer reviews, helping you make an informed decision.

3. Check Financial Stability:

The financial stability of an insurance company is a critical factor in ensuring that it can fulfill its financial obligations, especially when it comes to paying out claims. Independent rating agencies, such as A.M. Best, Moody’s, and Standard & Poor’s, assess the financial strength of insurance companies. Look for companies with high ratings, as this indicates a strong financial foundation and the ability to meet their obligations.

4. Evaluate Customer Service:

Customer service is a key aspect of a reliable insurance company. A company that values its customers and provides excellent service is more likely to address your concerns promptly and efficiently. Consider the accessibility of customer service channels, such as phone support, email, and online chat. Evaluate the responsiveness and helpfulness of customer service representatives by checking customer reviews and testimonials.

Additionally, inquire about the claims process and how the company handles claims. A transparent and efficient claims process is crucial in times of need, ensuring a smooth experience when filing and resolving a claim.

5. Assess Reputation and Reviews:

The reputation of an insurance company within the industry and among its customers is a valuable indicator of reliability. Look for reviews and testimonials from policyholders to gauge their satisfaction with the company’s services. Pay attention to reviews that highlight positive experiences with claims processing, customer service, and overall satisfaction.

Explore online forums and social media platforms where individuals share their experiences with different insurance companies. Keep in mind that no company is perfect, but patterns of consistent positive or negative feedback can provide valuable insights into the reliability of an insurance provider.

6. Consider Coverage Options:

Evaluate the range of coverage options offered by each insurance company. A reliable provider should offer flexible coverage options that align with your specific needs. Consider not only the types of coverage available but also the limits, deductibles, and any additional features or riders that may enhance your protection.

For example, if you’re looking for auto insurance, assess whether the company provides comprehensive coverage, collision coverage, and liability coverage. In the case of health insurance, consider the network of healthcare providers, coverage for pre-existing conditions, and any wellness programs or additional benefits offered.

7. Inquire About Discounts and Bundling:

Many insurance companies offer discounts based on various factors, such as a clean driving record, home security features, or bundling multiple policies. Inquire about available discounts and explore whether bundling your insurance policies (e.g., combining auto and home insurance) can result in cost savings. Reliable insurance companies are transparent about the discounts they offer and provide clear information on eligibility criteria.

8. Check Licensing and Regulatory Compliance:

Ensure that any insurance company you consider is properly licensed and compliant with regulatory requirements. State insurance departments regulate insurance providers, and they often provide online tools to verify the licensing status of companies. Checking for proper licensing ensures that the company operates within the legal framework and is accountable to regulatory authorities.

9. Ask for Recommendations:

Seeking recommendations from friends, family, or colleagues can provide valuable insights into the experiences of people you trust. Inquire about their interactions with insurance companies, including the claims process, customer service, and overall satisfaction. Personal recommendations can offer a more nuanced perspective and help you make an informed decision.

10. Review Policy Terms and Conditions:

Before finalizing your decision, carefully review the terms and conditions of the insurance policies offered by each company. Pay attention to coverage limits, exclusions, and any conditions that may affect your ability to file a claim. A reliable insurance company provides clear and transparent policy documents, and representatives should be willing to explain any aspects that may be unclear.

11. Explore Technology and Online Services:

The use of technology and online services can enhance your experience with an insurance company. Reliable providers often offer user-friendly websites and mobile apps that allow you to manage your policies, file claims, and access information easily. Consider whether the company provides digital tools that align with your preferences and make the insurance process more convenient.

12. Seek Professional Advice:

If navigating the complexities of insurance feels overwhelming, consider seeking advice from insurance professionals. Independent insurance agents or brokers can provide personalized guidance based on your specific needs and circumstances. These professionals can help you navigate policy options, understand coverage details, and make an informed decision.

In Conclusion: Trusting Your Choice

Finding a reliable insurance company requires a combination of research, careful consideration, and a clear understanding of your needs. By defining your insurance requirements, evaluating financial stability, assessing customer service, and considering coverage options, you can navigate the insurance landscape with confidence.

Remember that the reliability of an insurance company is not solely determined by premiums but encompasses a broader spectrum of factors. Trust your instincts, seek recommendations, and leverage the wealth of information available to make a choice that aligns with your priorities. Ultimately, a reliable insurance company is one that not only provides comprehensive coverage but also demonstrates a commitment to customer satisfaction and financial stability, ensuring your peace of mind in the face of life’s uncertainties.