Insurance is like a safety net, providing financial protection and peace of mind in times of uncertainty. Whether it’s health, life, auto, or any other type of insurance, selecting the right coverage for yourself requires careful consideration and understanding of your unique needs. In this guide, we’ll explore key factors to help you navigate the complex world of insurance and make informed decisions that align with your priorities.

1. Assess Your Needs: Know What You Want to Protect

The first step in choosing the right insurance is to assess your needs. Identify the aspects of your life or property that are most valuable and require protection. For example, if you’re focused on safeguarding your health, health insurance should be a priority. If you own a home, homeowners’ insurance becomes crucial. By understanding your priorities, you can tailor your insurance coverage to meet your specific needs.

2. Understand Different Types of Insurance: Educate Yourself

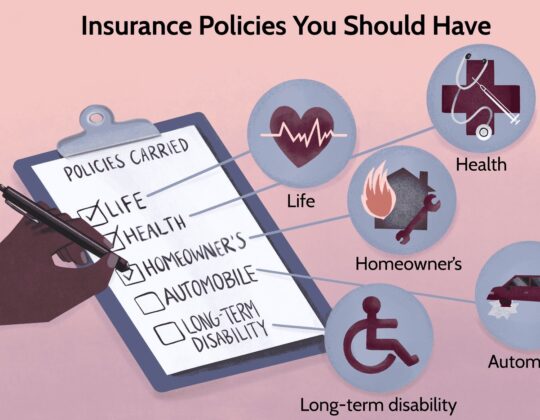

Insurance comes in various forms, each serving a distinct purpose. Familiarize yourself with the different types of insurance available, such as health, life, auto, home, and even specialized coverage like pet or travel insurance. Each type addresses specific risks and provides coverage in unique situations. Knowing the basics will empower you to make informed decisions about the types of insurance that are relevant to your circumstances.

3. Set a Realistic Budget: Determine Affordability

While insurance is an essential investment, it’s crucial to set a realistic budget. Determine how much you can comfortably allocate to insurance premiums without compromising your overall financial well-being. Keep in mind that cheaper premiums may come with higher deductibles or limited coverage, so find a balance that aligns with your budget and provides adequate protection.

4. Research and Compare: Shop Around for the Best Deals

Insurance providers vary in terms of coverage options, premium rates, and customer service. Take the time to research and compare offerings from different insurance companies. Look beyond just the cost – consider the reputation of the company, customer reviews, and the range of coverage options available. Online comparison tools and reviews can be valuable resources in this research phase.

5. Evaluate Deductibles and Coverage Limits: Find the Right Balance

Understanding deductibles and coverage limits is crucial when choosing insurance. The deductible is the amount you pay out of pocket before the insurance coverage kicks in, while coverage limits determine the maximum amount the insurance company will pay for a covered loss. Evaluate these factors carefully to find the right balance between affordable premiums and adequate coverage.

6. Consider Your Life Stage: Tailor Coverage to Your Life Circumstances

Your insurance needs may evolve as you progress through different stages of life. A young professional may prioritize health and disability insurance, while a homeowner with dependents may need comprehensive life and property coverage. Regularly assess and update your insurance coverage to align with your current life circumstances.

7. Think About the Future: Choose Long-Term Sustainability

When selecting insurance, think about the long-term. Consider how your needs may change over time and choose policies that offer flexibility or allow for adjustments as your circumstances evolve. A policy that suits your needs today may not be sufficient in the future, so look for options that provide ongoing value and adaptability.

8. Examine Policy Exclusions: Be Aware of What’s Not Covered

Carefully read and understand the policy exclusions. Insurance policies often come with limitations and situations that are not covered. Knowing these exclusions is as important as understanding what is covered. If there are specific risks you want coverage for, ensure the policy doesn’t exclude them.

9. Seek Professional Advice: Consult an Insurance Agent or Broker

If navigating the intricacies of insurance feels overwhelming, don’t hesitate to seek professional advice. Insurance agents or brokers have expertise in the field and can guide you through the process. They can help assess your needs, provide tailored recommendations, and clarify any confusing terms or conditions.

10. Review and Update Regularly: Stay Proactive

Insurance is not a set-it-and-forget-it arrangement. Regularly review your insurance coverage to ensure it aligns with your current needs and circumstances. Life changes, and so should your insurance. A proactive approach ensures that you are always adequately protected.

In Conclusion: Empowering Yourself Through Informed Choices

Choosing the right insurance for yourself is a personal and empowering journey. By assessing your needs, educating yourself, and considering your budget and future plans, you can make decisions that provide the protection and peace of mind you deserve. Remember that insurance is a dynamic aspect of your financial portfolio, and regularly reviewing and adjusting your coverage ensures that you stay resilient in the face of life’s uncertainties. So, take charge, be informed, and make choices that prioritize your well-being and financial security.